You're Almost to Your Report! – But First, Scroll Down & Consider Selecting One of These Free Offers

Click on any investing offer that interests you—it will open in a new tab, so you won’t lose your place as you move toward your report.

🚀 Scroll down now to check out these top investing offers on your way!

Gold breaks $5,000…

but THIS has beat gold by 1,000x

While everyone’s buying gold, smart folks are doing something else

Dear Reader,

Gold just surged past $5,000 an ounce.

Up almost 25% in the last six months.

And 45% in the last year.

But we believe this is just the start.

Weiss Ratings' in-house gold expert Sean Brodrick … who has been tracking precious metals for over three decades … believes gold could surpass $6,900 very soon.

However, here's what Sean knows that most people don't …

Every time gold has made big moves, there's another investment that has done WAY better.

Imagine banking 21 times … 49 times … 157 times … 218 times … even 1,386 times more than just holding physical gold.

It happened in the 1970s.

It happened in 2008.

And Sean thinks it could happen again right now.

The best part? You don't need to buy a single gold coin to have a chance at gains like that.

Most folks have no idea it even exists, but this is the exact same strategy that gave smart investors an opportunity to make an incredible 26,000% gain during a past gold bull run.

With gold at record highs right now and showing no signs of stopping, this opportunity is heating up fast.

Don't delay.

Click "Yes, Tell Me More!" to see how this strategy works.

Trump’s Endgame?

This could upend the U.S. economy

Dear Reader,

If you want to know Trump’s endgame with the trade war…

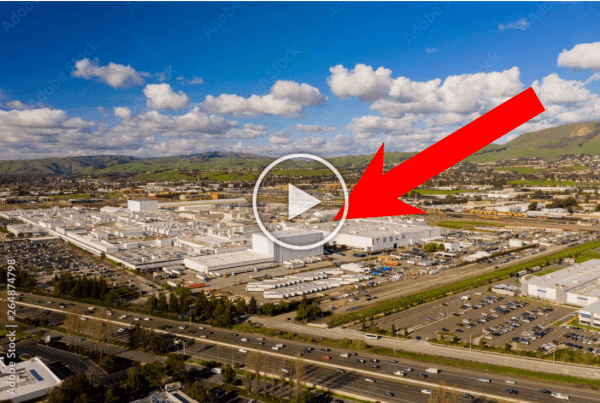

Take a look inside this factory on the edge of Silicon Valley.

Right now, it’s ground zero for a bold experiment.

One involving a strange new technology that could ignite a $12 trillion manufacturing revolution…

And hand early investors a shot at once-in-a-generation gains.

I call it Trump’s “New Golden Age” Tech…

Because it could finally let him steal the manufacturing crown from China.

NVIDIA’s CEO, Jensen Huang, calls this technology “the next multi-trillion-dollar industry.”

And Elon Musk put it even more bluntly:

“If you’ve got [Trump’s ‘New Golden Age’ Tech], there is no meaningful limit to the size of the economy.”

I’ve put together a short report showing how you could get in on the ground floor…

But, please, don’t wait…

The biggest gains could vanish the moment the world catches on.

Click "Yes, Tell Me More!" below to see the full story.

The Memecoin Opportunity No One Is Talking About

This under-the-radar memecoin has massive upside

Dear Investor,

We just identified what we believe is the #1 memecoin opportunity in the market right now.

And we're not talking about Dogecoin, Shiba Inu, or any of the memecoins you've already heard about.

This is something different. Something with massive upside potential that's still flying completely under the radar.

Here's what makes this memecoin special:

-

Strong community momentum building behind it right now…

-

Institutional interest that is rare for a memecoin…

-

Unique “utility” that separates it from the millions of other memecoins…

-

Early-stage entry point before the mainstream catches on…

-

Catalysts on the horizon that could send it significantly higher…

Our memecoin research team has been tracking this coin closely, and everything is lining up for a potential massive breakout.

But timing is critical. The best gains in memecoins go to those who get in before the explosive move—not after.

Discover the #1 Memecoin To Own Right Now (time sensitive).

This opportunity won't stay hidden forever. Click "Yes, Tell Me More!" below to see why we believe this could be the memecoin play of the year.

Silver is now the best growth and income play

Hi, Tim Plaehn here.

Silver has become one of the best investments for both growth AND income.

I've just found one tiny fund that is now delivering up to 20% in annualized cash distributions….

And could deliver $1,170 every month for you.

However that's not all….

The share price has jumped 68% in just 5 months.

This is one of the rarest combinations I've seen in 20 years of analyzing investments.

Click "Yes, Tell Me More!" below to see how this works.

Wall Street Stockpicker Names #1 Stock of 2026

Dear Reader,

The legendary quant who built one of Wall Street's most popular buying indicators just announced the #1 stock to buy for 2026.

And for a limited time, he's sharing this new recommendation live on-camera, completely free of charge.

He spent 50 years working alongside legendary investors like George Soros, Michael Steinhardt, Steve Cohen, and Paul Tudor Jones.

His work is coded into every Bloomberg terminal on Wall Street, and is still used by hundreds of banks, brokerages, and hedge funds to this day.

So why is he giving away his #1 buy recommendation for FREE?

It's all comes back to a shocking new market prediction for 2026.

This same legend - who accurately predicted the 2020 covid crash, the 2022 bear market, and the 2023 bank run - is now calling for an abrupt, surprising shift in the U.S. stock market.

The last time this happened, average investors lost over a fifth of their portfolio in just a matter of months.

So I got him to agree to an exclusive sit-down interview, where I got the whole story.

You'll get his #1 buy recommendation for 2026 when you click below.

To pick these recommendations, he consulted the same system that he used when CNBC's Jim Cramer said he'd never bet against him.

So I urge you to take advantage before it's too late.

Click "Yes, Tell Me More!" below now to see the names and tickers while you can.