You're Almost to Your Report! – But First, Scroll Down & Consider Selecting One of These Free Offers

Click on any investing offer that interests you—it will open in a new tab, so you won’t lose your place as you move toward your report.

🚀 Scroll down now to check out these top investing offers on your way!

Gold’s headed to $10,000 …

Here’s the secret way to play it.

Dear Reader,

Gold’s been on a tear lately.

Up almost $2,000 an ounce in the past year.

It’s caught many on Wall Street by surprise …

But not Sean Brodrick.

Right after Trump’s election, he predicted a significant event would happen …

Sending gold past $3,200.

Many laughed when he said gold was going to rise by over $1,000.

But that laughter turned to awe …

When Sean’s prediction came true within two days.

In August, he said it would soar past $4,100 in the very near future.

And it did so less than two months later.

He even said in December it would cross $5,000 early in 2026 …

Which just happened.

In fact …

Sean’s had the golden touch for more than two decades …

Calling the top and every gold bull market for over 20 years.

Now he says that gold is headed to $7,000 soon …

With $10,000 on the near horizon.

But despite the yellow metal’s white-hot run …

Sean says there’s a way to make even more than buying gold.

One that’s made savvy investors in the past as much as 31 times more …

65 times more …

Even as much as 469 times higher than just buying gold.

To learn all the critical details, click "Yes, Tell Me More!" below.

[Revealed] What Wall Street does behind closed doors

These billion dollar firms can have a huge impact…

Dear Trader,

There are multi-billion dollar firms having a huge impact on the stock market… that most traders have never heard of.

I’m not talking about Goldman Sachs or Berkshire Hathaway…

Instead, I’m talking about market makers.

Firms like Citadel and Jane Street and Optiver… who make enormous amounts of money by providing liquidity to trading markets…

And can move those markets… without most traders ever knowing.

But if you do know what these firms are likely to do…

Well that can give you a HUGE edge as a trader.

That’s why we spent over $100,000 on proprietary data feeds to build a special tool for tracking tickers that could see a huge move from market maker activity.

Now of course all of that sounds good in theory…

But the real question is - can this tool actually give traders a shot at real world profits?

Well since I started using it, I’ve had over an 86% win rate on real money trades…

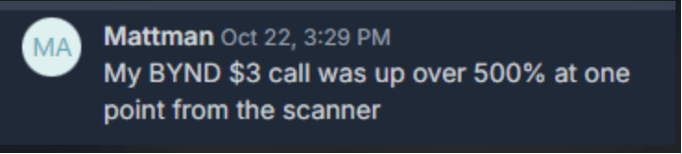

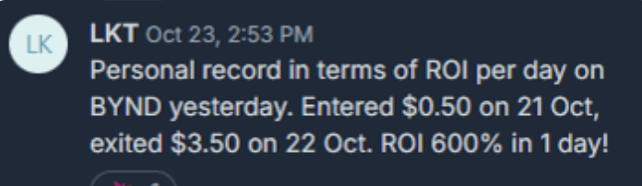

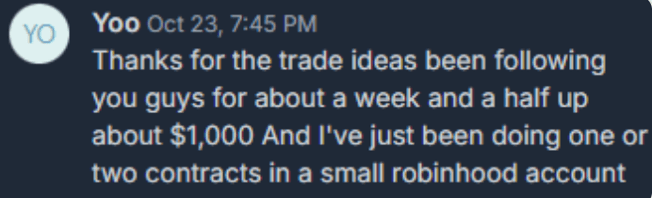

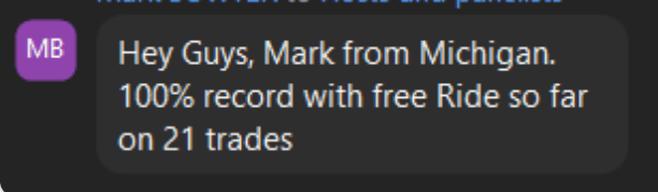

And some of my top beta testers have done even better:

*Estimated Starting Stake: $500

Granted, there were smaller wins, and those that did not work out, and we certainly cannot make reckless guarantees when it comes to trading…

But I have never seen results like this in all my years of trading.

And the best part is you don’t have to take my word for it…

Click the button below to see how you can try out my brand new scanner for free.

Trump Planning to Use

Public Law 63-43:

Prepare Now

Dear Reader,

If you have any money in the markets…

Public Law 63-43 could have a huge impact on your wealth in 2026.

Grants President Trump the power to make this critical move on May 15th.

President Trump himself has confirmed the plan is already in motion.

As a former advisor to the CIA, the Pentagon and the White House…

I know for a fact there are meetings taking place right now behind closed doors in the White House.

His entire administration is preparing for it.

I recommend you prepare as well.

Click "Yes, Tell Me More!" below to see the details because I believe this single move will help unleash a historical supercycle of wealth… That “gift” will make a lot of patriots rich on America’s 250th anniversary.

A Potential Breakout Is Brewing —

Get the Report & Real-Time Alert

Before certain stocks suddenly start appearing everywhere…

There’s usually a quiet phase first.

Very little attention.

Almost no buzz.

But behind the scenes, something begins to shift.

That’s exactly the stage our team believes one little-known company may be entering right now.

We’ve just finished compiling a full report on the situation — including what’s changing and why the setup is attracting attention internally.

Right now, most people still haven’t heard about it.

Which is why we’re making the report available while things are still early.

When you access it, you’ll receive:

• The full breakdown of the company and why the setup stands out

• The key factors suggesting a potential breakout phase could be forming

• A free real-time text alert if the moment we’re watching for begins

Click the button below to Get the Free Report + Alert

*By clicking the button above you are opting in to receive emails from Krypton Street

Did Trump just Turbocharge the "29% Account"?

Trump's energy policies could send this account into overdrive

Dear Reader,

For 137 years now…

A little-known public land trust has been quietly sitting on millions of acres of American land...

Paying royalties on every drop of energy that gets pulled out of the ground.

Oil. Natural gas. Even water.

Every barrel. Every cubic foot. Every gallon.

The checks just keep rolling in.

It’s so profitable… a single $1,000 investment since January 2000 turned into $556,000!

That works out to a 29% return… every year for 25-straight years.

You can check out the details by clicking here.

But get this…

Donald Trump just TURBOCHARGED the entire opportunity…

He just pledged $500 billion to develop massive new AI data centers – and he’s beginning with this specific area.

More drilling means more royalties.

More royalties mean bigger payouts.

Bigger payouts mean even better returns for anyone holding what I call "The 29% Account."

The big banks figured this out decades ago.

BlackRock, Wells Fargo, JPMorgan — they've all quietly parked billions here.

Now you can do the same.

Click "Yes, Tell Me More!" below to start tapping this cash gushing machine before drilling starts.