Your article is just one click away, but before you continue, we'd like to give you exclusive access to the most sought-after investment offers in our network - completely free!

Scroll down to discover an opportunity

that could give your portfolio a real edge!

that could give your portfolio a real edge!

[Revealed] What Wall Street does behind closed doors

These billion dollar firms can have a huge impact…

Dear Trader,

There are multi-billion dollar firms having a huge impact on the stock market… that most traders have never heard of.

I’m not talking about Goldman Sachs or Berkshire Hathaway…

Instead, I’m talking about market makers.

Firms like Citadel and Jane Street and Optiver… who make enormous amounts of money by providing liquidity to trading markets…

And can move those markets… without most traders ever knowing.

But if you do know what these firms are likely to do…

Well that can give you a HUGE edge as a trader.

That’s why we spent over $100,000 on proprietary data feeds to build a special tool for tracking tickers that could see a huge move from market maker activity.

Now of course all of that sounds good in theory…

But the real question is - can this tool actually give traders a shot at real world profits?

Well since I started using it, I’ve had over an 86% win rate on real money trades…

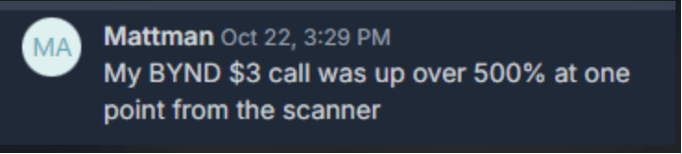

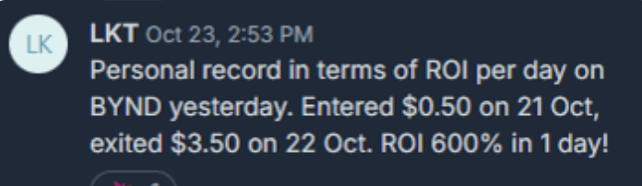

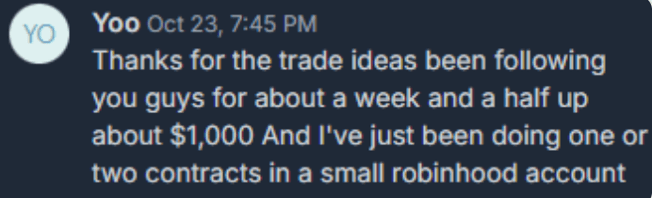

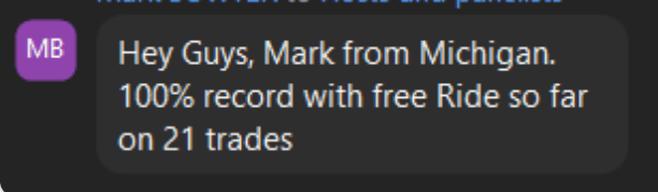

And some of my top beta testers have done even better:

*Estimated Starting Stake: $500

Granted, there were smaller wins, and those that did not work out, and we certainly cannot make reckless guarantees when it comes to trading…

But I have never seen results like this in all my years of trading.

And the best part is you don’t have to take my word for it…

Click the button below to see how you can try out my brand new scanner for free.

Wall Street Legend Says

This $15 Stock Could be the #1 Stock of the Year

This is your rare second chance to get in NOW.

Dear Reader,

One of the market’s greatest “sleeper stocks” may be about to wake up.

And Wall Street has begun to take notice.

The ticker shot up 5% in a single week as analysts recently raised its price target – and elevated the stock from a “Hold” to a “BUY.”

In fact, one 50-year Wall Street legend just named it his #1 stock of 2026 – live, on-camera.

When you see the role this company is playing in a $269 billion market, you’ll understand why he’s telling his 800,000 followers to put $1,000 into the stock NOW.

(And why BlackRock even made a multi-billion-dollar offer to buy the company behind it.)

Right now, institutional investors hold over 50% of the stock.

But the tide may soon be about to change, as more and more retail investors catch onto its extraordinary potential.

The best part?

As of this writing, it’s trading just around $15 a share.

That’s one-twelfth the price of Nvidia (NVDA).

So if you missed out on NVDA’s extraordinary runup…

This is your rare second chance to get in NOW, before this undervalued stock could become one of the best-performing stocks of the new year.

Click "Yes, Tell Me More!" below to get the name and ticker, 100% free.

*By clicking the link above, you will begin receiving the Chaikin PowerFeed newsletter and occasional marketing messages.

A Potential Breakout Is Brewing —

Get the Report & Real-Time Alert

Before certain stocks suddenly start appearing everywhere…

There’s usually a quiet phase first.

Very little attention.

Almost no buzz.

But behind the scenes, something begins to shift.

That’s exactly the stage our team believes one little-known company may be entering right now.

We’ve just finished compiling a full report on the situation — including what’s changing and why the setup is attracting attention internally.

Right now, most people still haven’t heard about it.

Which is why we’re making the report available while things are still early.

When you access it, you’ll receive:

• The full breakdown of the company and why the setup stands out

• The key factors suggesting a potential breakout phase could be forming

• A free real-time text alert if the moment we’re watching for begins

Click the button below to Get the Free Report + Alert

*By clicking the button above you are opting in to receive emails from Krypton Street

Gold breaks $5,000…

but THIS has beat gold by 1,000x

While everyone’s buying gold, smart folks are doing something else

Dear Reader,

Gold just surged past $5,000 an ounce.

Up almost 25% in the last six months.

And 45% in the last year.

But we believe this is just the start.

Weiss Ratings' in-house gold expert Sean Brodrick … who has been tracking precious metals for over three decades … believes gold could surpass $6,900 very soon.

However, here's what Sean knows that most people don't …

Every time gold has made big moves, there's another investment that has done WAY better.

Imagine banking 21 times … 49 times … 157 times … 218 times … even 1,386 times more than just holding physical gold.

It happened in the 1970s.

It happened in 2008.

And Sean thinks it could happen again right now.

The best part? You don't need to buy a single gold coin to have a chance at gains like that.

Most folks have no idea it even exists, but this is the exact same strategy that gave smart investors an opportunity to make an incredible 26,000% gain during a past gold bull run.

With gold at record highs right now and showing no signs of stopping, this opportunity is heating up fast.

Don't delay.

Click "Yes, Tell Me More!" to see how this strategy works.

Silver records prices are great.

Monthly income is better

Hi, Tim Plaehn here.

Silver posted record breaking prices.

And analysts at Bank of America believe there's still more room to run, with price targets as high as $309.

But here's the problem with just buying silver...

You don't collect a penny until you sell.

That's why I'm focused on something different.

The real opportunity is to collect monthly income from silver.

A quiet $42 fund I recently uncovered is taking advantage of silver's historic run and delivering massive monthly payouts in the process.

I'm talking about the potential to collect up to $1,170/month.

Discover the silver income breakthrough most investors are missing.

The next payout is just days away.

Don't miss this. Click "Yes, Tell Me More!" below.